IOSS may sound like an Apple operating system to the average person, but to the small to medium e‑commerce retailer, it’s the next hurdle, following Brexit, for business to consumer sales into the EU.

If you’re an online retailer looking for answers about IOSS, the following Q&A with Tony Mathews, our Head of Fulfilment at Cloud Fulfilment, answers some of the key questions we’ve been asked by our e‑commerce customers.

Q: What is IOSS?

A: The Import One Stop Shop (IOSS), is a new way for businesses in non-EU countries, including the UK, to declare and pay VAT on goods sold to customers in the EU. The key benefit of this new system is that businesses will only have to register for VAT in one EU state, rather than each country they sell into.

The launch of the IOSS was delayed due to the pandemic, but It’s expected to take effect from 1 July. From this date, non-EU businesses selling to consumers in the EU will be able to register for VAT in just one EU state and file a single VAT return for all EU transactions up to the value of €150.

The registration process for IOSS will pose some administrative challenges for online retailers, but the overall objective is to simplify and streamline the process of declaring and paying VAT across multiple EU states and therefore make selling into Europe easier.

Q: How do you register for IOSS?

A: Sellers can register on the IOSS portal of any EU Member State. However, non-EU businesses will need to appoint an EU-established intermediary to register for IOSS on their behalf and act as their VAT representative in the EU.

We’re recommending Avalara as the intermediary for our customers (see the bottom of this page for 10% off IOSS registrations). Other alternatives include companies like Taxamo and Deloitte.

Once you’re registered, you will be given an IOSS identification number.

Q: How does the IOSS work?

A: Sellers registered for the IOSS need to apply VAT when selling goods destined for a buyer in the EU. The VAT rate is the one applicable in the EU Member State where the goods are to be delivered.

This means you will need a duty calculator on your store to calculate the right rate to charge your customers. Or you could use a delivery service that calculates the tax due and charges it to you, the retailer.

When you ship your goods, you will need to provide your chosen shipping partner with your IOSS number which they will declare when your goods transit the EU border. This shows customs that the VAT has already been paid

Q: Can all retailers selling into the EU use IOSS?

A: If you import goods into the EU from outside the EU on a B2C basis, you can use IOSS (where the consignment value sent to the consumer is €150 or below). Note that the consignment value is key here, rather than the value of the individual items that comprise it.

IOSS does not cover excise duties (typically applied to alcohol or tobacco products).

Q: Do all non-EU retailers selling into the EU have to register for IOSS?

A: It’s not compulsory. As an alternative, businesses can register for and then declare and pay VAT in each of the EU countries in which they sell to consumers. However, this is an administrative nightmare and the reason the IOSS was created.

Q: Are there any other alternatives to using the IOSS?

A: An alternative to IOSS, and something many of our customers are using in conjunction with IOSS (for consignments over €150,) is DDP. DDP (Delivered Duties Paid) is a shipping method that enables duties and taxes to be paid by the seller or added to the basket total at the checkout. This takes care of any VAT or duty costs prior to delivery, so the end customer doesn’t get any unexpected charges when their goods are delivered.

DDP has become increasingly popular post-Brexit for UK retailers shipping to the EU and is available from most major couriers. Typically, a duty calculator will be applied to the checkout of your online store to calculate the duties owed. You can then choose to pay these on behalf of your customers or include the cost in the basket total.

Q: Do I need to register for IOSS if I sell through a marketplace?

A: If your business sells solely through a marketplace such as Amazon or eBay, then you won’t need to register for IOSS. After 1 July, the marketplace that has facilitated the sale will be responsible for collecting VAT on imports to the EU (up to €150) from non-EU countries.

So, if you’re based in the UK and you sell an item on eBay for €100 to a customer in Europe, eBay will collect the VAT at the point of sale and declare it on your behalf. eBay will provide you with an IOSS number which you’ll need to pass on to your chosen shipping partner to show that the VAT has already been paid.

Q: What happens with transactions over €150?

A: In our experience, the basket spend of an international customer is often higher than a domestic customer, due to the natural urge to want to maximise on the shipping fees, so many consignments will be over €150 and fall outside the IOSS bracket.

Under these circumstances, the retailer can choose a DDU service, where the customer pays the duties and tax on delivery (not popular with most customers as we saw back in January when Brexit came into effect). Or what we’re seeing more of now is DDP delivery where duties and tax are included in the total cost at the checkout – this offers the best customer experience.

Q: What about the current VAT exemption thresholds?

A: The €22 VAT exemption on small parcels being imported into the EU for delivery to consumers will be withdrawn. This means that all parcels shipped to Europe will be subject to VAT.

Unfortunately, this exemption was abused by many sellers under-declaring the import value of goods to avoid VAT. The introduction of IOSS means that VAT must be charged at the point of sale for transactions up to the value of €150, therefore levelling the playing field for bricks and mortar retailers.

Q: How does IOSS work if you use a 3PL?

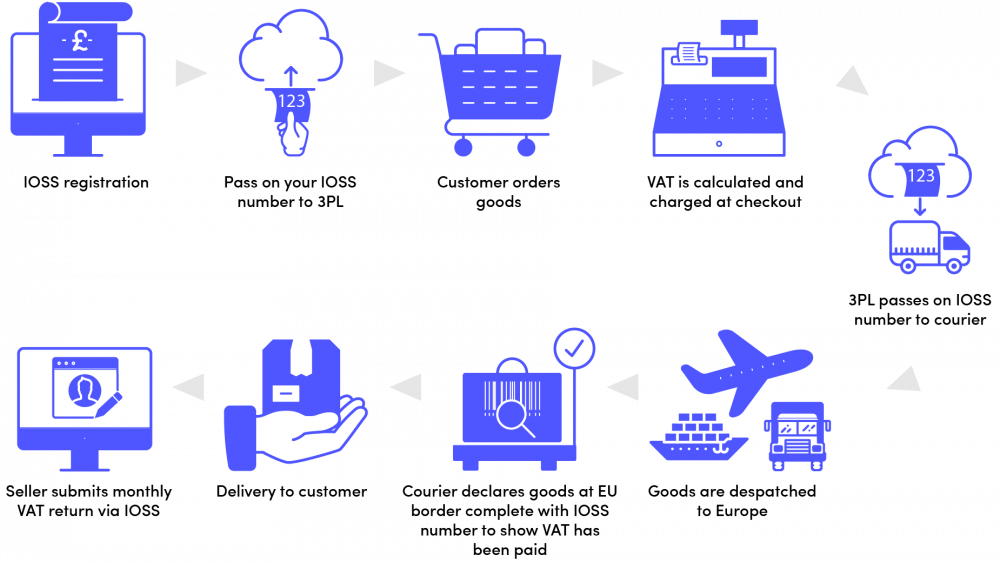

A: If you use a third-party logistics partner (3PL) to fulfil and dispatch your orders, you’ll need to register for IOSS then provide your fulfilment supplier with your IOSS number. Once you have the IOSS number your 3PL should hold that number and pass it on to the carriers so that your goods will pass smoothly through customs.

If you’d like to find out more about working with Cloud Fulfilment and how we can offer you stress-free shipping to Europe please get in touch.

For 10% off your IOSS registration with Avalara email [email protected]